FOR IMMEDIATE RELEASE

May 12, 2020

(512) 463-0107

Cristie.Strake@senate.texas.gov

Property owners have until May 15 or 30 days after being noticed, whichever is later, to protest their value

Houston, TX – In the mist of reopening Texas from the COVID-19 pandemic, Senator Paul Bettencourt (R-Houston) is reminding most Texans that the deadline to protest their property appraisal is Friday, May 15, or critically 30 days from receiving the CAD notice, whichever is later. Major state CADs, including Bexar, Dallas, El Paso, Tarrant are mailing accounts as late as the end of May. While the deadline in Harris County for 1.1 million taxpayers is May 15th, this will vary across the state with protest deadlines as late as the end of June. “Due to this wide gap in deadlines, it is critical that each taxpayer check their own notices as you only have 30 days from the date of receipt to protest your value.” said Senator Bettencourt.

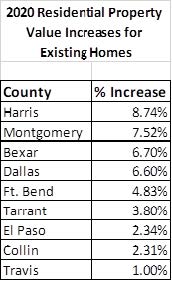

The table below shows the average rate of residential increase before hearings for major CADs across the state. While Harris County has the highest rate of increase they also have the highest rate of settlement at over 53,000 cases already settled with many of them below last years’ values. The value range increase goes down to 1 percent in Travis County. “Many CADs launched online protest in 2020 due to the COVID-19 pandemic and taxpayers should use these FREE services to protest their value easily online instead of getting in line.” said Senator Bettencourt.

In Tarrant County for example, 283,345 properties saw a decrease of the 662,100 residential and commercial accounts. In Fort Bend County, homeowners in two different county Commissioner precincts saw average home values decline, while average home values increased in the other two.

Ultimately, a property owner’s tax bill is determined by the property tax rate adopted by the taxing entity that is set on the appraised value. Property tax rates will be set in the Fall by the over 4,000 individual taxing entities across the State of Texas per Senate Bill 2, House Bill 3 and the Texas Property Tax code.

Recent Attorney General Opinions have included that taxpayers shall have the right to an in person hearing if requested even though the vast majority will probably use virtual hearing capability that the CADs are offering this year. Also, a physical damage constitutional amendment was ruled not germane to economic damage, which in turn underscores the need for value protest to proceed normally.

“Taxpayers have more input and transparency throughout the entire tax rate setting process due to Senate Bill 2,” continued Senator Bettencourt. “Taxpayers should take a ‘Texas two-step’ of reviewing and protesting their property values and should be prepared to speak up more than ever during the tax rate setting process as major changes have been made on the posting of tax rates and online information due to Senate Bill 2.” he added.

Senator Bettencourt is the Chairman of the Senate Committee on Property Tax.

###